Will Real Estate Crash Soon?

Why it won’t go down much

TL;DR if you can get at least a 5-10% discount, jump on it

1. Fundamentals are different this time. Supply and demand are balanced and likely to hold up better than 08 recession. Current data indicates that SF, LA, and NY are the only major metros where supply is now higher than before corona.

Source: Zillow Data on Listing Increases by City

2. Supply is at record lows and banks/mortgage lenders have dramatically changed their ways since the last recession. Conservative underwriting means less loans being given out and often towards income generating properties. (attached infographic below, notice the huge drop)

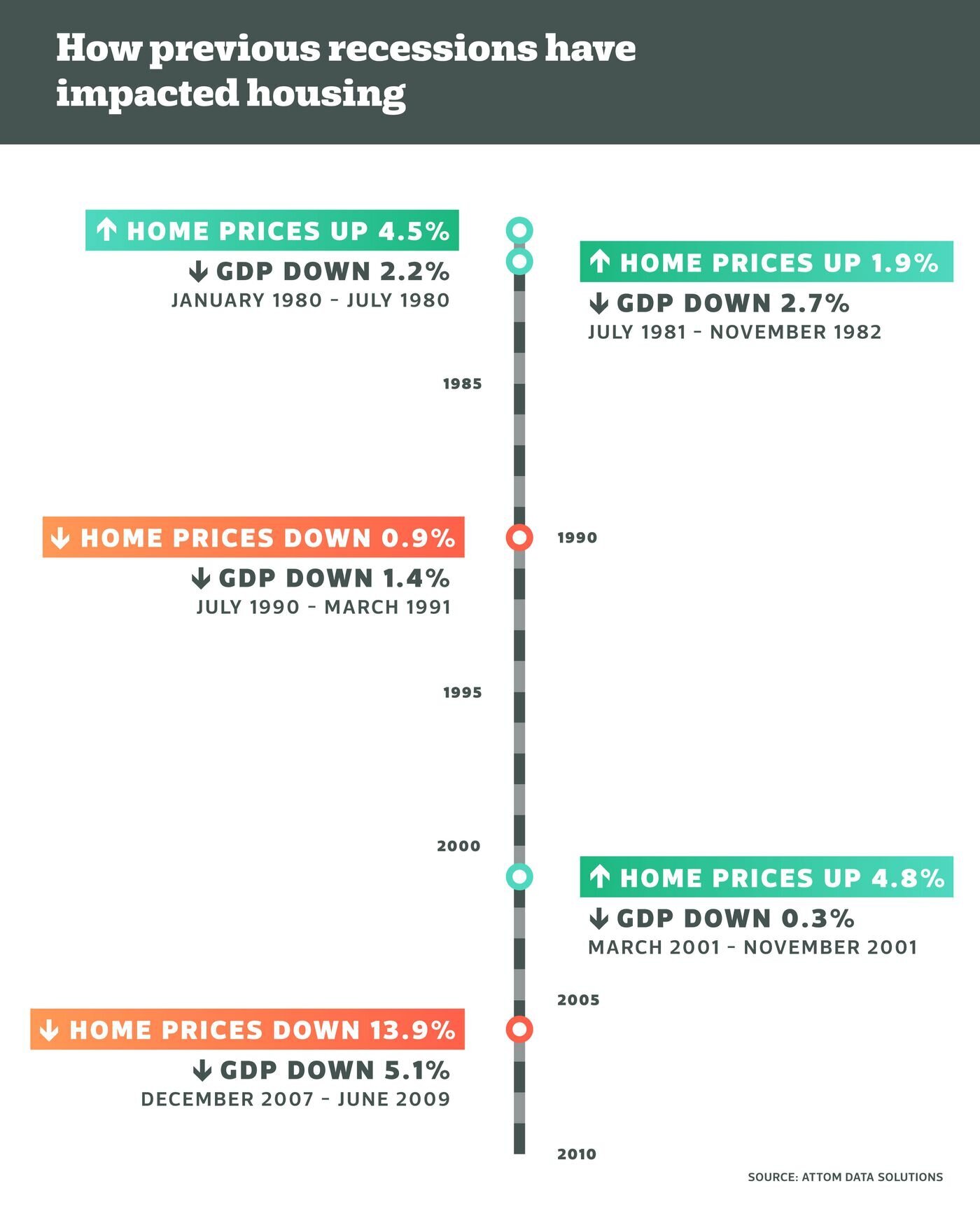

3. It will likely be similar to prior recessions besides 08/09 where real estate didn’t really change much. (attached infographic below, some recessions housing prices went up)

4. The reason prices kept dropping was people had to sell their homes but no one could buy since banks had stopped giving out mortgages. This meant only cash buyers were able to take advantage of the cheap properties. The loans haven’t dried up, and have actually increased although that will peter out eventually

How to take advantage of the coming recession

1. People are still going to sell their homes if they unfortunately lose their jobs and need to pay things off bills. The next few months will see prices drop, I've been hearing a lot about Q1 but not by like 50% as with the last recession. I’d recommend looking around now to know the numbers so you'll be ready to pull the trigger when a deal comes across your table.

2. Markets most affected will be those that depend on tourism heavily like in Florida or Vegas. Sales are up there, but they also top the list in terms of mortgage delinquencies. You'll likely see the biggest discounts there. Industries most affected will be retail or hotels. As you can see multifamily (apartments) are still holding up pretty well and are likely to weather the storm.

3. Hoard cash. Cash is king when things go bad and no one else can get rents

4. It’s common knowledge that the best “A class neighborhoods” suffer the most vacancies in the recession as people down grade to cheaper rentals. (Case and point SF proper vs the surrounding areas) Normally those neighborhoods don’t make much cash in the first place, but it’s one of the few opportunities to get a discount in the best areas.

5. Otherwise, “B and C class neighborhoods” will be flush with renters. In the last recession, rent went up in some areas. If you bought correctly, it doesn’t matter if the value of your property goes down, what matters is that it goes back up in the long run and you can survive the mortgage crunch with your rental income because cashflow is 👑